Decades late reporting worrisome inflation, Statistics Canada enables inaction on housing affordability

Canadians are now hearing a lot about our inflation woes. But it’s surprising that this story is only just taking centre stage when rampant inflation to the largest expense faced by all Canadians – housing – has been the norm for the last 20 years.

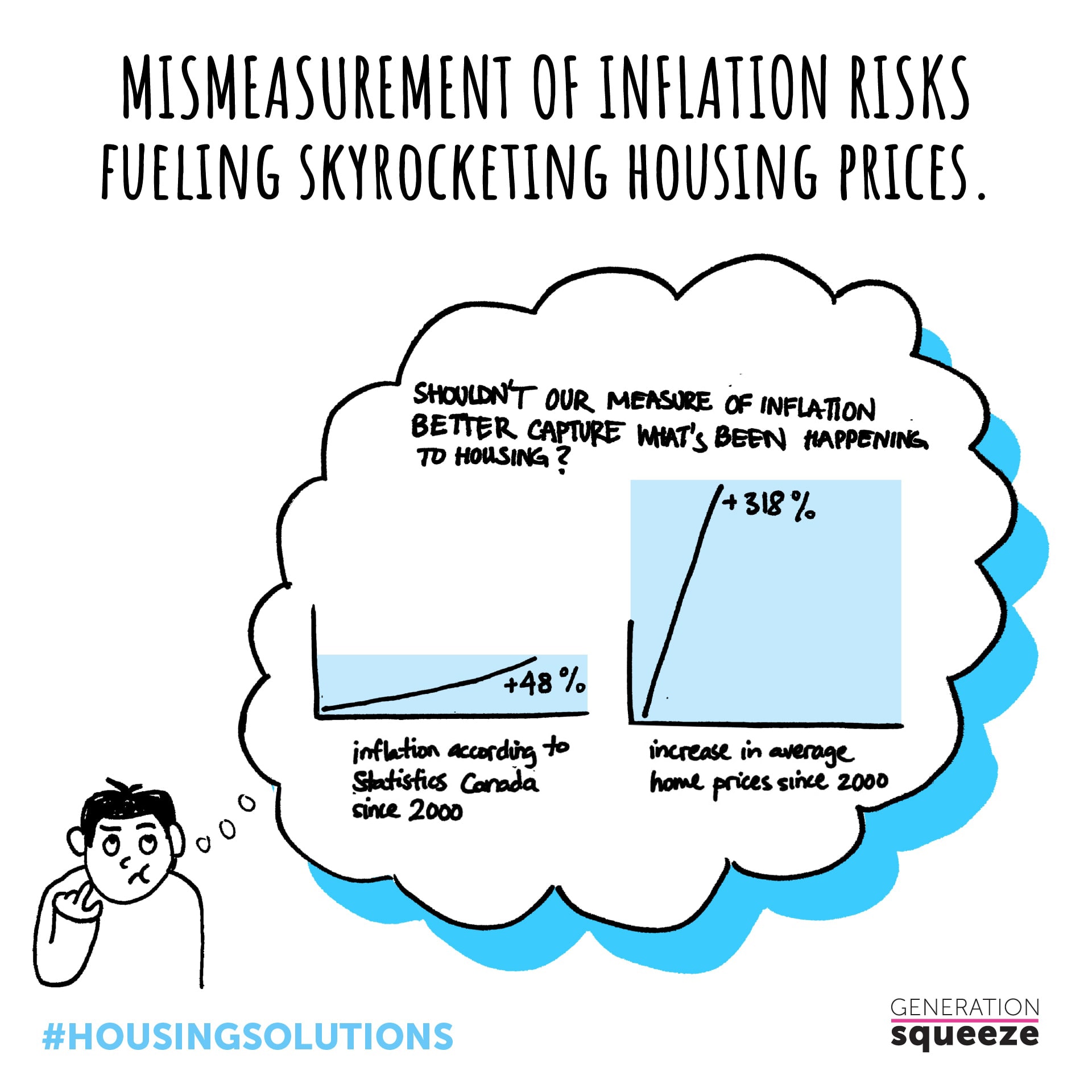

Since 2000, average home prices have risen by a whopping 318%, based on calculations using Canadian Real Estate Association data. Statistics Canada reported that total inflation over the same period rose by 48%.

While Statistics Canada has a well-earned, strong reputation for data collection and analysis, this data disconnect signals something is off with how it measures the contribution of housing to inflation. It’s alarming that the relentless escalation of home prices has had seemingly little impact on reported levels of inflation, because rising prices have increased unaffordability for anyone who didn’t already own a home, while creating wealth windfalls for those who already did.

Just like the right road signs help keep us safe by making traffic clearer and more predictable, the right economic signals help steer our financial systems towards stability, prosperity and equity. Unfortunately, the housing inflation signals sent by Statistics Canada gave us the green-light to speed recklessly through intersection after intersection, putting ourselves and others in danger. If we’d gotten the signals right years ago, we could have recognized the perils of runaway housing inflation sooner, sparing younger generations the challenge of coping with soul-crushing levels of unaffordability.

Just like the right road signs help keep us safe by making traffic clearer and more predictable, the right economic signals help steer our financial systems towards stability, prosperity and equity. Unfortunately, the housing inflation signals sent by Statistics Canada gave us the green-light to speed recklessly through intersection after intersection, putting ourselves and others in danger. If we’d gotten the signals right years ago, we could have recognized the perils of runaway housing inflation sooner, sparing younger generations the challenge of coping with soul-crushing levels of unaffordability.

Some will rightly celebrate that low interest rates have been important for fuelling the economy out of recessions, including during the pandemic. Some individuals also use low interest rates as a pathway to home ownership, hacking together a personal solution to a housing system that’s been broken by the massive gap between home prices and earnings.

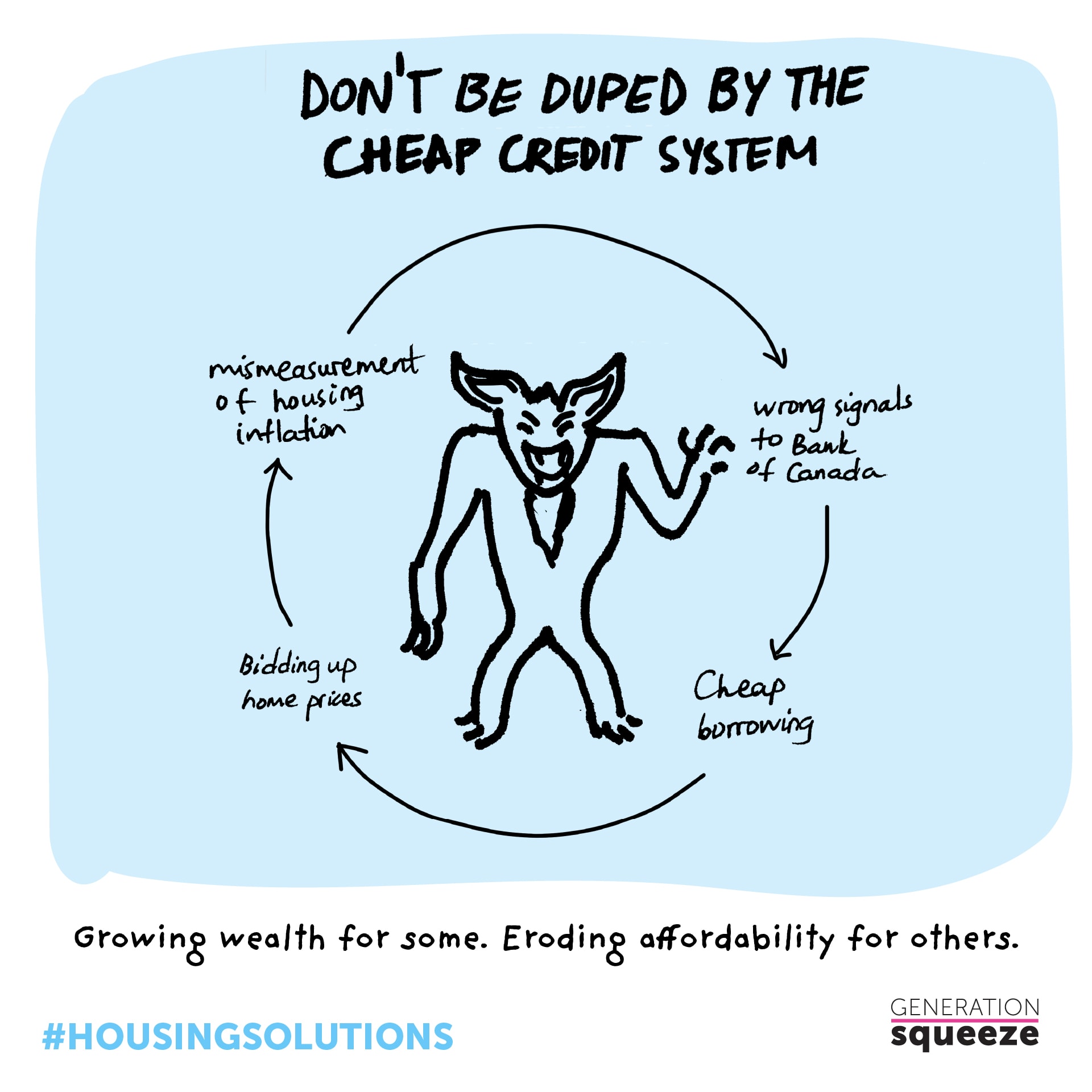

But that individual hack sustains the systemic problem. For anyone struggling to afford a place to call home, the reason you should care about the mismeasurement of housing inflation is that it reinforces the darker-side of the cheap credit system. This system betrays many Canadians by fuelling home price increases far beyond what hard work can earn, devaluing your money, and devaluing your hard work!

Not familiar with how the cheap credit system works? Here’s a primer.

Statistics Canada underestimates the contribution of rising home prices to inflation. The Bank of Canada uses this (inaccurate) inflation signal to guide decisions on interest rates – keeping them at historic low levels because inflation is reported to be modest. Low interest rates decrease the cost of taking on a larger mortgage. Buyers who are able to borrow more bid up home prices. Rising prices aren’t adequately captured in inflation data… and there’s your feedback loop, sustaining the cheap credit system, growing the gap between home prices and earnings.

In effect, the cheap credit system has helped to create the two-part crisis of housing unaffordability and wealth inequality in which Canada is now entrenched. Younger people, renters of any age, and newcomers to Canada face crushing unaffordability, while many home owners feel entitled to hold onto the rising wealth their homes have generated.

There’s no silver bullet to restore housing affordability or reduce housing wealth inequality. But there are many incremental steps we can take! Increasing housing supply, revamping tax policies, and protecting renters, are all important. But so is ensuring that accurate information about inflation drives our monetary policy.

Statistics Canada is the authority on measuring inflation, so let’s task it to remedy the disconnect between housing prices and its calculation of inflation. The mismeasurement of housing inflation has enabled policy inaction in the face of Canada’s greatest affordability challenge. By failing to get the numbers right, we’ve stood idly by while skyrocketing housing inflation has yielded unfair wealth windfalls for many homeowners that have eroded affordability for many, often younger, Canadians.

Dr. Paul Kershaw is a policy professor in the UBC School of Population Health, and Founder of Generation Squeeze (www.gensqueeze.ca)

Andrea Long is the Generation Squeeze Senior Director for Research and Knowledge Mobilization