Canada's home ownership tax shelter

Our deep dive into a $10-billion policy that fuels housing unaffordability

Tax season leaves many people wondering how governments use our hard-earned money. Our new report highlights the hidden costs of a tax policy that worsens wealth inequality but the majority of Canadians don’t know exists: the home ownership tax shelter.

Gen Squeeze has long argued for rebalancing our tax system to fix growing inequalities between young and old Canadians. Reducing the home ownership tax shelter is a critical way to tackle our affordability crisis and generational unfairness in our housing system.

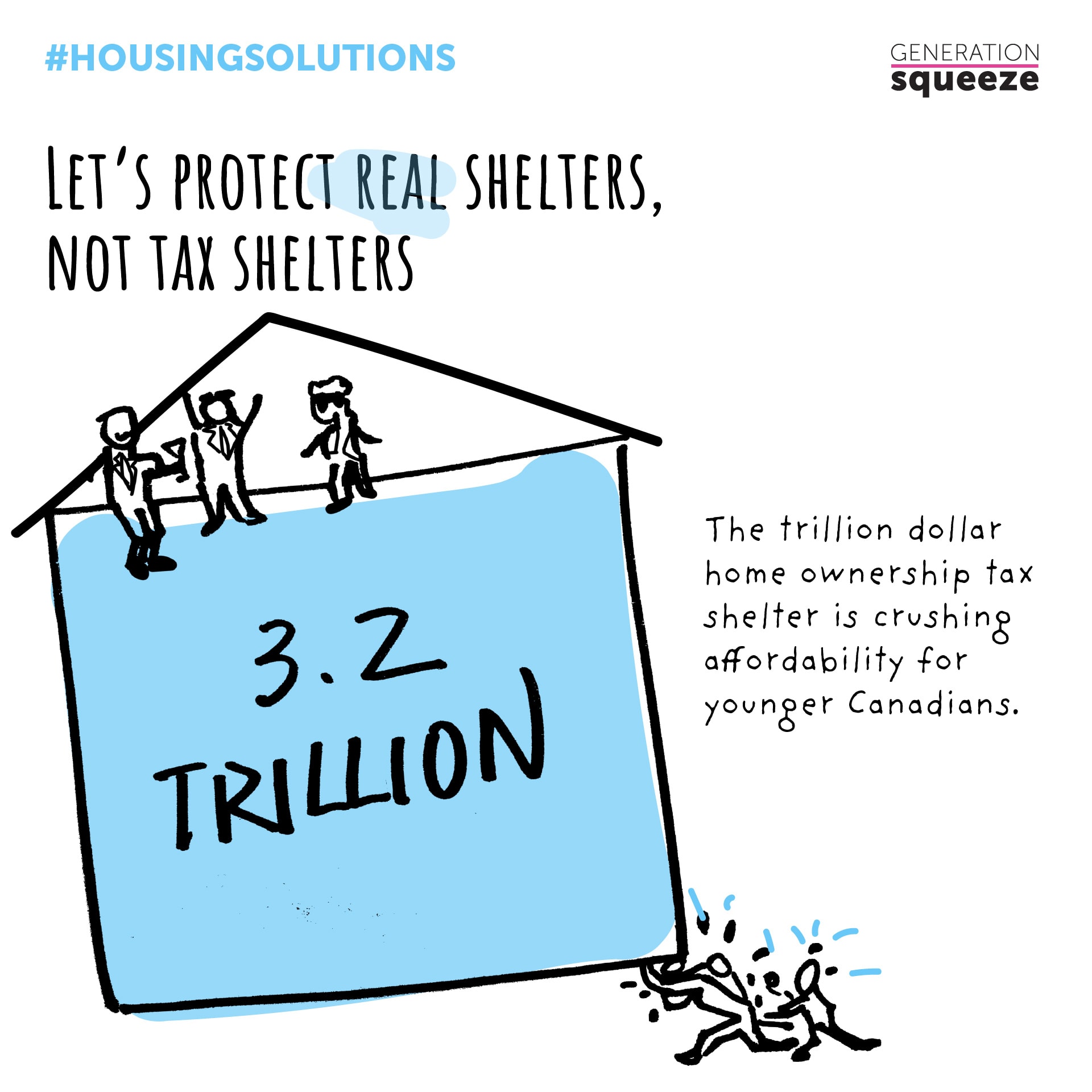

When home values rise, the wealth gained by home owners is sheltered from taxation. Wages from hard work are taxed far more heavily than housing wealth windfalls gained while home owners sleep and watch TV. That’s important, because Canadian home owners have gained an additional $3.2 trillion in housing wealth since the mid-1970s—most of it tax free.

Read the full report in the Canadian Tax Journal

Why we wrote this report

We want more people to know that rising home values are sheltered from taxation

Polling shows that 52% of Canadians don't know about this tax shelter. Foregoing tax revenue is effectively a government expenditure. This policy cost the Government of Canada $10 billion in 2022, and provinces lost billions more from their coffers. This makes the home ownership tax shelter by far the largest housing subsidy offered in Canada. But there’s no mention of it in the National Housing Strategy or government budgets.

The home ownership tax shelter fuels wealth inequality and generational unfairness

Older home owners who bought into the market decades ago have gained the most housing wealth from rising prices. At the same time, those not yet in the housing market—like many younger people, as well as newcomers to Canada—are burdened by home prices that have left earnings behind. The tax shelter also gives an unfair boost to home owners in hot markets while shafting residents of the Prairies and Atlantic Canada.

Key takeaways

The home ownership tax shelter motivates Canadians to want home prices to rise even more

Canadians feel deep suspicion about grocery store CEOs pocketing large profits from food inflation. So why aren’t we equally concerned about home owners reaping wealth gains from housing inflation? When rising home values offer owners a tax-sheltered way to grow wealth, it’s no surprise that price increases are welcomed by many—despite collateral damage to affordability. Unlike increases in food or fuel costs which harm affordability across the board, the fact that rising home prices benefit many (often older) home owners is a key reason why we’re seeing far less urgency on actions to bring these prices down.

The home ownership tax shelter is driving growing wealth inequality

The enormous housing wealth generated by rising prices has become a key marker of inequality. The housing ‘haves’ enjoy wealth windfalls spurred on by favourable tax treatment. The housing ‘have nots’ face insurmountable prices, or enormous mortgage debt.

The home ownership tax shelter distorts our economy

Sheltering housing wealth from taxation helps accelerate investment in real estate at the expense of investment elsewhere, including in sectors that generate more employment. Real estate contributes 14% of Canada’s GDP, but just 2% of Canadians are employed in this sector.

Canadians are open to disrupting the home ownership tax shelter

Polling shows that Canadians are willing to consider changes to the tax treatment of housing. But political leaders are lagging behind, instead of bravely addressing this harmful policy.

What we recommend

Disruption – not elimination

Eliminating the home ownership tax shelter is not the first or the best step to adapt tax policy to address housing wealth inequalities and unaffordability challenges (for the policy wonks out there, explore the technical reasons why in the full study). Instead, we suggest chipping away at the tax shelter with another tool.

Put a modest price on housing inequity

To apply downward pressure on the skyrocketing housing prices that have landed Canada in an affordability crisis, we recommend adding a small surtax on homes valued over $1 million. This surtax would start at 0.2% and peak at 1%. Payment of the surtax could be deferred until the home is sold, to ensure high-value home owners with lower incomes aren’t put at risk.

What you can do

Test drive these talking points:

- Earnings from hard work shouldn’t be taxed more than wealth home owners gain from rising home prices while they sleep and watch TV.

- Just like offshore tax shelters motivate moving money out of Canada to preserve assets, the home ownership tax shelter motivates us to bank on rising home prices to gain wealth.

- By turning home ownership into an investment strategy, we’re crushing affordability and harming younger people and newcomers to Canada. It’s time to protect real shelters, not tax shelters.

Let your elected reps know you aren’t scared to talk about the home ownership tax shelter

Politics responds to those who organize and show up. Many Canadians are ready for a conversation on tools to disrupt the home ownership tax shelter—so let’s tell our political leaders that it’s time for them to step up too.

Share this information far and wide

Help us make sure more Canadians know about the home ownership tax shelter and its impact on housing, inequality, and generational fairness. Download and share our graphics on social media:

|

|

|

|

Check out our housing solutions

No single action will fix our dysfunctional housing system. Our comprehensive housing policy solutions map out paths to making good homes affordable by 2030.