Poll: Majority of Canadians support a price on housing inequity

Only 10% of Canadians who own million-dollar homes would pay levy

Generation Squeeze partnered with Research Co. to explore what Canadians think about housing wealth and affordability. What our poll found is that many Canadians would be willing to go further than politicians expect to check home price escalation.

Most notably, a majority of respondents’ support putting a modest price on housing inequity to reduce unaffordability and wealth inequity, and to raise revenue for other supports Canadians want and need. Even among the 10% of Canadians who would be asked to pay this new levy, a majority are on board.

We should celebrate those among us willing to contribute a small amount of their housing wealth to help put the brakes on crushing levels of unaffordability. Intergenerational solidarity is alive and well when a majority of home owners are willing to ally with those being pushed out of the housing market (like their kids and grandkids).

Now we need to infuse the world of politics with this same solidarity. Our poll suggests many Canadians are open to changing a dysfunctional housing system that pits younger aspiring home owners working to overcome the chasm between home prices and earnings, against older established home owners who bought into the market decades ago and have watched as rising prices created wealth windfalls.

Gen Squeeze has the solutions for generational fairness to make this happen. Join us in turning these solutions into reality!

DOWNLOAD FULL POLL DATA [Excel]

Highlights Table of Contents

-

Canadians recognize the harm caused by skyrocketing home values to younger people and newcomers

-

A majority of Canadians are willing to disrupt the home ownership tax shelter

-

Support for disrupting the home ownership tax shelter spans political parties, regions

Canadians recognize the harm caused by skyrocketing home values to younger people and newcomers

We wanted to know how aware Canadians are of the intergenerational dimensions of the housing crisis. We asked respondents if they agreed or disagreed with the following statement: "Rising real estate prices hurt younger people and newcomers of any age who cannot afford a home." An overwhelming majority (86%) agreed with the statement!

Check out our in-depth exploration of these data here.

↑ Back to Highlights Table of Contents ↑

A majority of Canadians are willing to pitch in to help make homes more affordable via a price on housing inequity

The poll explored Canadian attitudes about a range of housing solutions, including changing the way we tax housing wealth by putting a price on housing inequity to reduce housing unaffordability and wealth inequality.

We found that 68% agreed with the idea of "[i]mplementing a modest surtax paid by the 10% who own the most expensive homes."

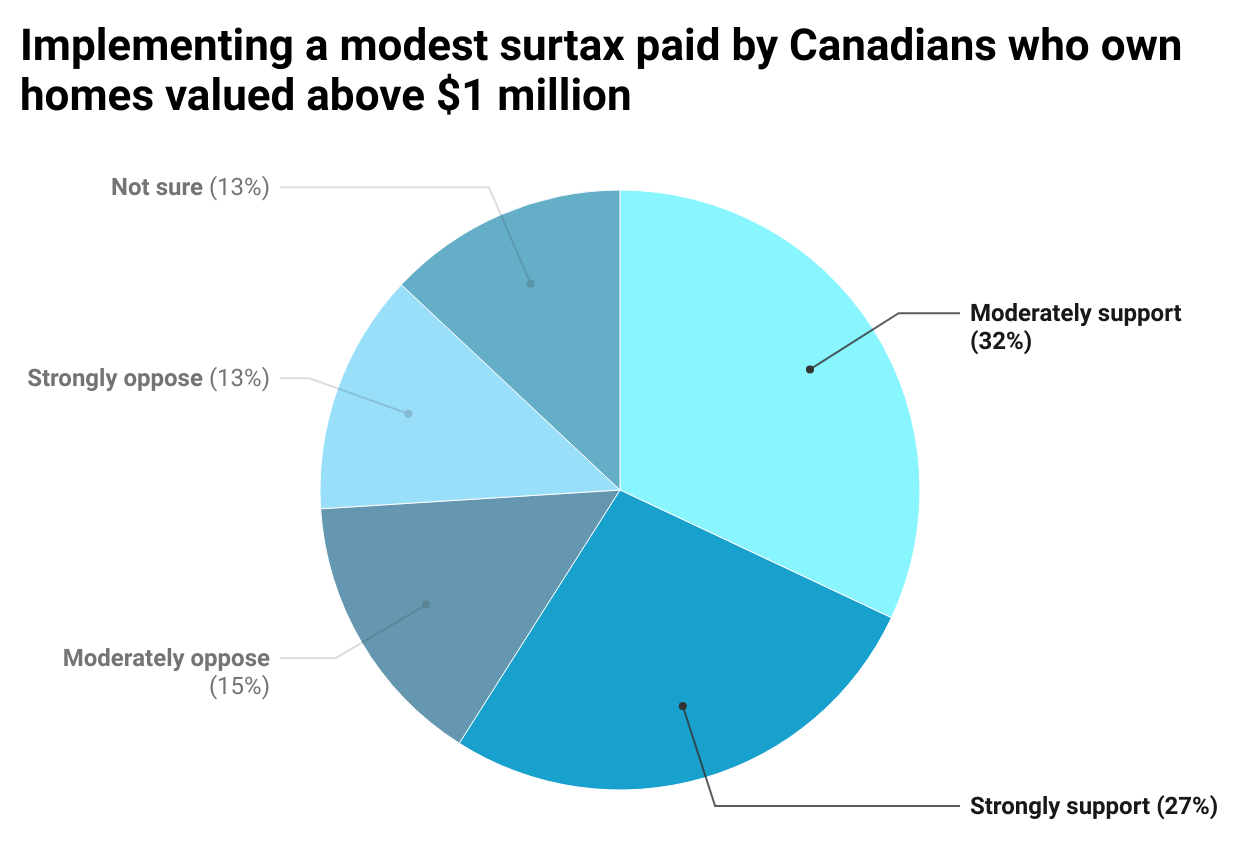

At the time the poll was conducted, homes valued above $1 million made up the 10% most expensive homes in the country. So we also asked respondents if they would be in favour of "[i]mplementing a modest surtax paid by Canadians who own homes valued above $1 million." We wanted to learn if asking the question in this way would make a difference in how people responded.

The new phrasing led to fewer respondents agreeing with the proposal—likely because some didn’t realize that owning a million-dollar home meant being in the top 10% most valuable real estate in Canada! Yet a comfortable majority (59%) still supported it. Less than half that amount (28%) opposed the idea of a surtax on homes valued above $1 million, with 13% saying they were "not sure.

Learn more about these poll data here.

↑ Back to Highlights Table of Contents ↑

Owners of $1 million homes who’ve benefited from housing price inflation support a price on housing inequity that they would pay

Housing inflation isn’t harming everyone—it’s generated significant wealth windfalls for many home owners, especially those who bought into the housing market decades ago.

One inspiring result from our poll is that owners of high-value homes who’ve benefitted from rising prices are willing to pay more to promote affordability and reduce inequity. Across Canada, 60% of poll respondents agree with this proposal. Among those who own homes valued at over $1 million, support is even higher, with 64% saying they’re on board.

We also asked Canadians if they support a price on housing inequity paid by owners of $1 million homes (rather than the top 10%). Support for this proposal drops slightly Canada-wide, to 55%. But crucially, 57% of poll respondents who own homes over $1 million still support a price on housing inequity—even when it’s clear that they would be the ones paying it!

Check out our blog diving more deeply into the data on Canadian attitudes about housing wealth, and whether owners of $1 million homes should be considered ‘wealthy’.

↑ Back to Highlights Table of Contents ↑

A majority of Canadians are willing to disrupt the home ownership tax shelter

This year marks half a century since the Government of Canada created the home ownership tax shelter. This shelter exempts increases in the value of principal residences from taxation. No other wealth windfall enjoys such favourable tax treatment.

Just like offshore tax shelters motivate moving money out of Canada to preserve assets, the home ownership tax shelter motivates Canadians to bank on rising home prices to gain wealth. Treating home ownership as an investment strategy means many regular Canadians benefit when home prices rise beyond local earnings—despite these same prices crushing affordability for younger generations, newcomers of any age, and older renters. In the mid-70s, it took the typical young person 5 years of full-time work to save a 20% down payment on an average priced home. Now it takes 17 years.

Poll results show that a majority of Canadians are now ready for governments to soften the sharpest edges of the home ownership tax shelter. Canadians are just as likely to blame this tax shelter for decreasing housing affordability as they are to blame “unethical behaviour by real estate agents,” “developers building the wrong kind of supply,” and “criminal activity (such as money laundering).”

Since Ottawa created the home ownership tax shelter in 1972, home values have increased hundreds of thousands of dollars across Canada—more so in BC and Ontario. One result is that many owners have gained substantial housing wealth, largely tax-free. This is especially so for the ~10% who own homes valued above $1 million. Owners don’t need sell their homes to access tax-sheltered wealth gains, because home equity lines of credit are now common in the finance industry.

Finance Canada reports that the home ownership tax shelter costs Canadians $10 billion annually at the federal level. It costs provinces another ~$5 billion. This makes the home ownership tax shelter by far the largest housing subsidy offered in Canada. At a time when politicians are descrying Canada’s housing affordability crisis, it may come as a surprise that we chose to subsidize so generously many of the most securely housed Canadians.

So far, federal and provincial politicians keen to tackle housing unaffordability have steered clear of disrupting the home ownership tax shelter because they fear any change would be unpopular. Our poll results show just the opposite: 62% of Canadians support “implementing a modest surtax paid by Canadians who own homes valued above $1 million.”

Check out this blog for more on the principal residence exemption, and what Canadians know and think about it.

↑ Back to Highlights Table of Contents ↑

Support for disrupting the home ownership tax shelter spans political parties, regions

The poll finds that a majority among voters for each of the big three political parties support disrupting the home ownership tax shelter: Conservatives (55%); Liberals (63%); and NDP (64%).

Support is especially high in Atlantic Canada (73%), the Prairies (72%), Alberta (68%), and Quebec (66%) where typical home prices are below the national average, and relatively few households own million-dollar homes. In BC and Ontario, where roughly 25% of households own homes valued above $1 million, one in two respondents supports the surtax.

A majority of Canadians (55%) agree that “the rise in housing wealth inequality is unfair to retirees in the Prairies and Atlantic Canada. They pay taxes on their pension income just like the retiree does in Vancouver or Toronto, but don’t gain the large amounts of home equity that many retirees in Vancouver and Toronto do. By failing to tax the wealth gained by owners in Vancouver and Toronto, we expect retirees in the Prairies and Atlantic Canada to pay more than their faire share of taxes.”

↑ Back to Highlights Table of Contents ↑

Support for a price on housing inequity goes up when the revenue raised pays for things Canadians want and need

A modest annual price on housing inequity would raise approximately $5 billion per year. Many poll respondents indicated their support for this proposal would increase if the tax change:

- Pays for income tax cuts for middle- and lower-earners (43%)

- Pays for more affordable housing (40%)

- Pays for more medical care, long-term care and pharmacare (39%) or child care (32%)

- Helps slow home price increases, so earnings have a chance to catch up (38%)

- Reduces wealth inequality (37%)

- Reduces inequality between owners and renters (32%)

- Reduces wealth inequality between homeowners in high value markets like Vancouver and Toronto, and homeowners in places where prices are not rising as quickly like Atlantic Canada, Quebec, and the Prairies (30%).

↑ Back to Highlights Table of Contents ↑