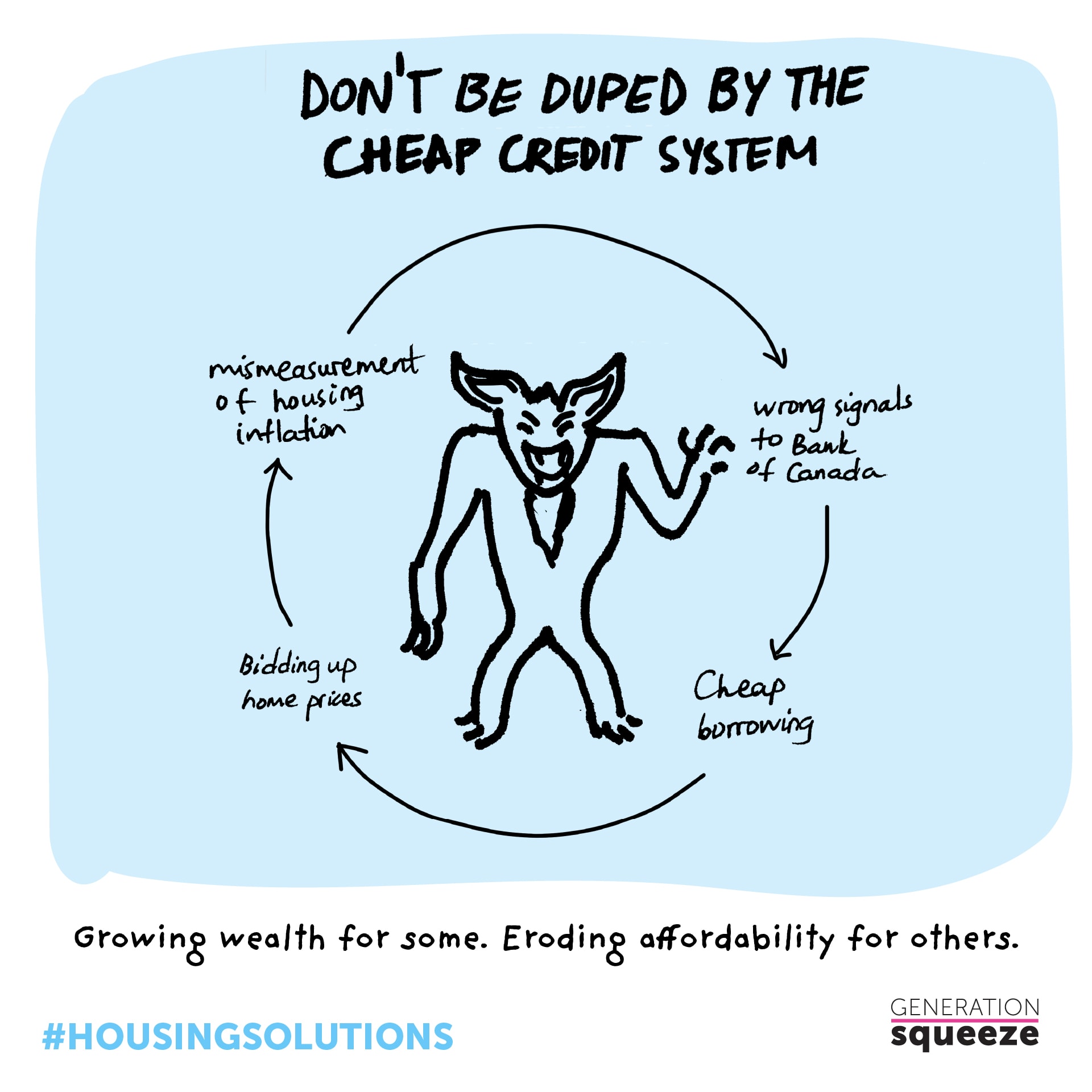

The Cheap Credit System

You might have heard us say that there’s no silver bullet to fix housing affordability - only silver buckshot. Housing supply is one piece of the puzzle, protections for renters is another, and so is tax policy. One-piece we haven’t talked about much yet is monetary policy.

Yes, we know it’s not exactly sexy. But for anyone struggling to afford a home, or anyone concerned about whether their kids can afford a home, things like interest rates and inflation are important.

If you’re really interested in the connections between monetary policy and housing affordability, keep reading! Otherwise, here's the lowdown on how our cheap credit system is contributing to Canada’s housing crisis.

- Housing prices have skyrocketed - but with little impact on Canada’s official inflation measure. That’s because Statistics Canada is failing to accurately measure inflation in home values.

- As a result, the Bank of Canada has been getting the wrong signal about real rates of inflation - and using this wrong signal to make decisions about things like interest rates, which remain at historic low levels.

- Lower interest rates entice everyone to qualify for bigger mortgages.

- Everyone qualifying for bigger mortgages drives up bidding for homes, which fuels skyrocketing prices. Owners gain wealth, while affordability is eroded for everyone else.

Frustrated? Don’t get mad, get organized! Read our new report on housing inequity that makes specific recommendations to help our monetary policy leaders minimize the collateral damage to younger Canadians from housing unaffordability.

Inflation and home prices

Inflation simply means increases in the price of things. When prices go up, the amount you can purchase with the same amount of money goes down. Money doesn’t stretch as far.

That’s what’s happening now. Inflation is rising, along with Canadians’ anxiety about affording the goods and services we need.

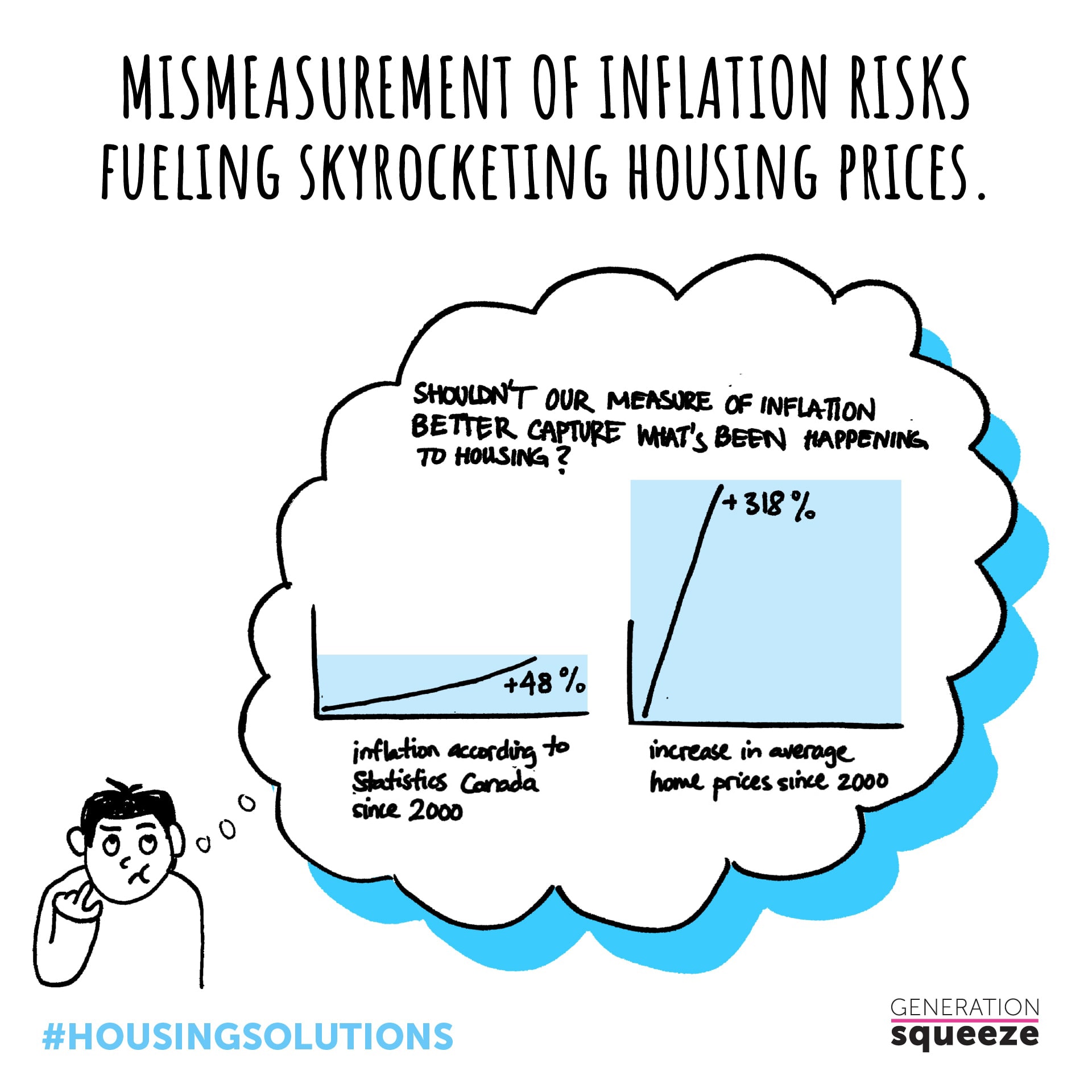

While attention to growing inflation has ramped up in the last few months, we could (and should) have known years ago that inflation was a risk in Canada. The evidence has been right in front of our eyes - massive increases in home prices.  Statistics Canada measures inflation using the Consumer Price Index (CPI). And for years the CPI has failed to accurately measure housing inflation.

Statistics Canada measures inflation using the Consumer Price Index (CPI). And for years the CPI has failed to accurately measure housing inflation.

This is a big problem, because the Bank of Canada, governments and businesses use these (incorrect) data on inflation to make decisions about interest rates, tax brackets, pensions, wages, etc. And these decisions don’t take into account runaway inflation in home prices or the harm they're causing, particularly for younger generations.

We need our inflation data to stop camouflaging how the primary cost of living – housing – is being driven up. The first step is fixing the faulty source. Our report calls on Statistics Canada to more accurately track housing inflation by:

- Relying less on the New House Price Index to track changes in home values and mortgages, and better integrating data on the price of established homes. Check out what the Business Council of BC has to say about the dramatic under-reporting of price inflation for established homes.

- Capture the cost of down payments and principal repayments. You may be surprised that Statistics Canada doesn't measure these costs when calculating inflation, even though they are the biggest expenses facing anyone trying to enter the housing system.

- Monitoring average home values relative to typical earnings (especially for young people entering the housing system), because a home should be in reach of what hard work can earn. Current measures focus on how much Canadians spend, not how much homes actually cost! What we spend is constrained by how much we earn, so as home costs go up, we spend more to buy less.

- The short- and long-term effects of monetary policy on demand for mortgage credit and housing inflation are important and need to be understood. As Canada's authority on inflation, Statistics Canada should report annually about the best available evidence about the influence of monetary policy on both housing wealth and housing affordability.

In short: it’s time to measure what’s really happening in housing inflation, so we can address the problem.

What makes interest rates interesting?

Interest rates are the main tool used by the Bank of Canada to influence inflation.

Higher interest rates put downward pressure on inflation because they make it more costly to borrow money for a loan or mortgage. Lower interest rates have the opposite effect. They motivate Canadians to borrow money, because it’s cheaper to repay it down the road when only a small amount of interest is being accrued.

Canada has had extremely low interest rates for years. If you’re in the market for a home, or have a mortgage to repay, you may think this is a good thing. We hear you! It’s hard enough to get into Canada’s overheated housing markets without higher interest payments adding to the cost.

But here’s the catch. The low interest rates you may be happy about now, are one of the things that have driven up home values and created our housing affordability crisis. That’s because low interest rates mean buyers can bid up prices, but still keep their monthly debt costs under control.

The result is a harmful spiral.

The result is a harmful spiral.

Homeowners want interest rates to remain low, because it makes their debt cheaper. Low interest rates mean home prices continue to rise. Homeowners begin to welcome rising prices, because they deliver a big return on their housing investment. Home price increases outpace earnings, pushing homes out of reach for more and more Canadians.

Many of us have been pulled into this spiral by doing nothing more than responding rationally to the circumstances in front of us. We know - we’re in the same boat. Just ask Gen Squeeze Founder Paul Kershaw, whose home in Metro Vancouver went up in value by half a million in 2021!

Regardless of our intentions, we have to wrestle with the fact that many of us are now part of a system that is crushing affordability for generations of younger Canadians.

To expose this harmful spiral, our report recommends that Statistics Canada report annually on the relationship between monetary policy and home prices. This is a first, easy step towards ensuring that monetary policy maximizes economic benefits while minimizing collateral damage to housing affordability. We should measure economic prosperity in terms of whether paying for the major cost of living – housing – requires more or less work, and whether the economy is sustainable socially, economically and environmentally.

Download & share our shareables!

|

|

|

|

Discover more

We have tolerated homes becoming more unaffordable by mismeasuring inflation: Part 1 of a new blog series| Housing Wealth and Generational Inequity | A Price on Housing Inequity | Statistics Canada proposes sticking with the status quo – no need to change harmful mismeasurement of housing price inflation - Generation Squeeze: Part 2 of a new blog series